Protecting Bitcoin, Blockchained Ukraine, Utopia or Inevitability. Cryptospace News digest, July 25 – 31

This week has passed without any disasters, giving the community a break, though some believe it’s a lull before the storm. Anyways, it’s interesting to recall the events that built it.

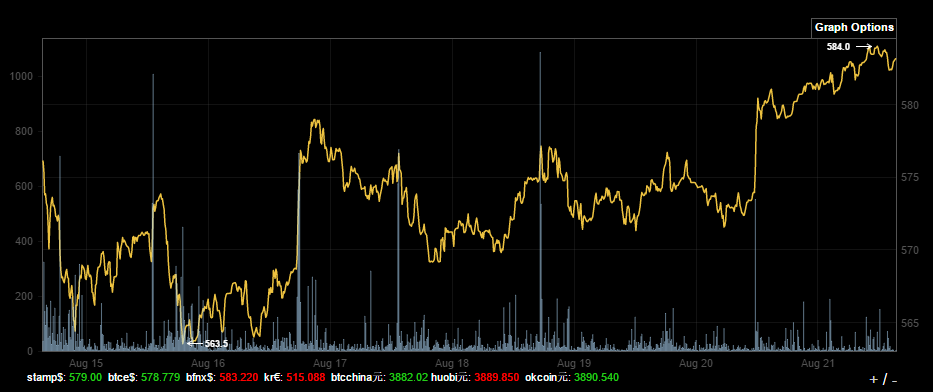

Bitcoin Price

By the end of the week, Bitcoin managed to gain some value, and currently it is traded at around $584. In the beginning of the week, the exchange rate dropped to $563, though generally the trend seems to be headed upwards. It’s quite possible that it all may precede something big. The question is when. As of today, bitcoin’s market cap stands at $9.2 million.

Segregated Witness

The forthcoming release of Bitcoin Core’s software going by the number 0.13.0 will incorporate SegWit code, which is aimed at improving bitcoin’s original structure while enhancing the network’s scalability. This, however, doesn’t mean that SegWit will be activated at once. The move is more like a preparation, as the implementation will become possible only once version 0.13.1 is released.

The long-expected event was preceded by a somewhat weird message at Bitcoin.org, which suggested that the website may be attacked by some allegedly Chinese hackers after Bitcoin Core 0.13.0 is released. The supposed attack, according to the message, would be supported by the government. Nobody actually knows what is this all about, however, Bitcoin Core urged everyone to keep calm and avoid unnecessary paranoia.

Exchanges

Bitfinex has stated that the investigation of the earlier attack is ongoing. However, the attack’s vector is still unknown, as the exchange has acknowledged. Bitfinex has also announced it hired Ledger Labs to analyze the security systems, audit crypto and fiat assets and liabilities of the exchange.

Another Hong Kong-based exchange, Gatecoin, three months after the attack that had halted its operations, has officially restored operations on August 17. The re-launch has been postponed due to CloudFare problems discovered in the last minute.

Wallets

KeepKey has become the industry’s first hardware wallet to integrate with ShapeShift. From now on, users may exchange bitcoins for litecoin and dogecoin instantly (and backwards) without registering a separate account.

Canada-based Decentral has issued yet another update of Jaxx with the addition of Dash, the market’s seventh most capitalized cryptocurrency. Dash has been integrated in version 1.0.9, which is available for all devices and platforms, including iOS.

Bitwala has announced its own cryptocurrency wallet, which enables the platform’s users to transact from their accounts using them as wallets. BitPay has announced that the company’s wallet CoPay now incorporates a function of direct purchasing using Amazon gift cards. The option is available in version 2.5.0, and now any Copay user may purchase Amazon’s gift cards ($1 to $500). The cards may be exchanged for goods at Amazon and some affiliated services.

Protecting Bitcoin

Former chairman of US SEC Arthur Levitt has criticized those being skeptical about bitcoin and predicting its inevitable demise. Such reaction was caused by this June’s report by Citi Research, which considered the way the technology may change the traditional market.

KnCMiner Will Be Saved

KnCMiner, which has earlier filed for bankruptcy, will be probably saved by GoGreenLight. The contract has been already signed.

Blockchain: Utopia or Inevitability?

Last week featured surprisingly many statements, with the common bottom line suggesting that blockchain is no cure for every problem financial institutions face. Thus, Pavel Kravchenko of Distributed Lab stated that the interest for blockchain technology is going down, and blockchain-related startups may start closing any moment now. In his opinion, big businesses aren’t ready to use blockchain, as it entails expensive modernization of IT infrastructure and requires new security procedures, to say nothing about the technology’s links to cryptocurrencies and decentralization, which aren’t the things that can make a big business happy.

Meanwhile, research company Gartner has presented a new report suggesting that blockchain has reached its popularity peak, and now users start suffering from too high expectations from the technology.

Another research came from Greenwich Associates. Therein, the agency states that most financial institutions are unsure about blockchain’s reliability in terms of confidentiality of transactions.

Nevertheless, the developments and researching continue. Hyperledger has announced it works on creating Hyperledger Explorer, an open-source tool providing free access to blockchain projects developed by the consortium’s members. In fact, it is Hyperledger’s own blockchain browser.

Japanese financial institutions are getting ready to develop a blockchain platform to reduce costs of internal and external currency servicing. The project has been initiated by Bank of Yokohama and SBI Sumishin Net Bank, with Ripple being responsible for the project’s technical part. The project is expected to be launched this October, with 15 Japan-based banks joining it.

The Australian Stock Exchange has announced it finished developing the payments system prototype based on distributed ledger technology. The system may potentially replace current solutions. The prototype was developed in cooperation with Digital Asset Holdings, with participation from Australia’s financial regulators and the exchange’s shareholders.

Innovation and Development Foundation is at the final stages of developing a blockchain-based platform for Ukraine’s State Service of Geodetics, Cartography, and Cadaster. The group has earlier implemented a similar system in Georgia, and in Ukraine’s public procurement platform ProZorro.

Investment

A new research by Juniper Research suggests that the first six months of 2016 saw $290 million of investment in blockchain and cryptocurrency industries. Circle, bitcoin wallet provider, Blockstream, and Digital Asset Holdings are leading the ranking. Juniper Research believes the banking industry is the most proactive when it comes to implementing blockchain solutions.

Ethereum Classic

August 18, London hosted the first official meeting of Ethereum Classic developers. They discussed the project’s global objectives, as well as legal and financial consequences of the hard fork. Speaking at the event were Simon Taylor, director for blockchain development at 11:FS, Ninshant Bhaska, CEO at Lloyds Banking Group, and Chandler Guo, who had initially been opposing the project. The organizers stated that the following meetups would be hosted by Zurich, Shanghai, Melbourne and Toronto.

In the Spotlight

Venezuela hits the headlines every now and then these days, mostly because of the financial apocalypse in the country. Our special feature sheds some light on life of the local bitcoin community.

Subscribe to our Newsletter

<Similar Content