Failing Exchanges, Blockchainization on the March, and Blooming Discussions. Cryptospace News for April 2-9

Our weekly overview highlights the most interesting tidings of this week.

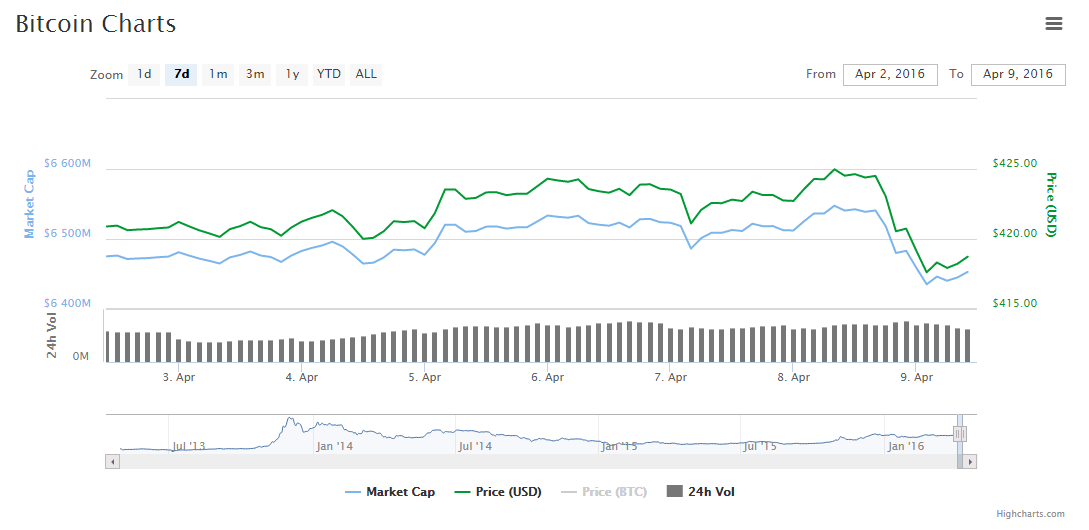

Bitcoin Price

Bitcoin has been stable for the better part of the week, with its price fluctuating between $418 and $423. However, Friday night it abruptly dropped to $414. Later on, it returned to $417.

Some experts believe that price stability is caused by a decrease in interest of traders, as it was volatility that attracted them in the first place. Blockchain advisor George Samman told CoinDesk current volatility rate was the lowest since 2013. He believes that it caused the trading volume to shrink though it may be a lull before the storm.

Zane Tackett of BitFinex seems to have a similar opinion. He says many traders prefer to observe the development of affairs now. Other factors conditioning current state of bitcoin include yet another holiday season in China and Catholic Easter.

Trouble with Exchanges

Popular crypto-exchange ShapeShift suffered an attack this week. Some of the company’s servers have been hacked, and the exchange lost a part of its funds though the exact amount of the loss wasn’t stated. However, ShapeShift insists customer funds are safe and sound.

Another exchange, itBit, suddenly halted operations in Texas this Friday. Notably, the company provided no explanation; one may only assume that it might have something to do with regulation issues. Texas is traditionally considered one of the most bitcoin-friendly states in the US.

Blockchain.info-owned trading platform ZeroBlock ceased operations a day earlier. Similar to itBit case, the company did not explain the decision.

Investment

Still, crypto-industry keeps on attracting funds. Thus, online retailer Overstock proceeded with implementing its initiative in the Caribbean. Last week, Overstock invested $4 million in bitcoin startup Bitt; however, it’s only the beginning, and the Barbados-based company will receive $16 million. The money will be used to update financial systems both in Barbados and other Caribbean nations via digitizing the region’s currencies.

Bitwala raised nearly $910,000 of investments to upgrade its existing payments system, as well as to expand its staff and clientele. Even though it has been one of the biggest investments in European bitcoin companies, the Dutch startup opted to highlight the importance of the investment instead of its amount. The company stated it would issue debit cards for free during the next month.

Platforms

British bank Barclays joined ranks with American startup Circle to launch a social payments app enabling users to send money by converting pounds into cryptocurrencies. Notably, it’s the first instance when a European ban allowed a cryptoindustrial company to use its infrastructure.

Digix, digital gold assets platforms, has successfully carried out “the first decentralized” campaign for tokens crowdsale on Ethereum blockchain. The company raised $5.5 in 14 hours.

Financial Markets Blockchainized

Seven major Wall Street players, namely Merrill Lynch, Citi, JPMorgan, Bank of America, Credit Suisse, Markit, and Axoni, have announced they successfully tested blockchain technology in credit default swaps. The test ran under the auspices of DTCC as of early March. Overall, the researchers tested 85 various cases. Now that the testing is complete, DTCC will have to decide whether the findings are sufficient to use the technology in real life applications.

Meanwhile, blockchain consortium R3CEV has struck a strategic partnership with Microsoft. The cooperation will provide consortium members with access to cloud tools on Azure and several other advantages. Also this week, R3CEV has publicized some details concerning blockchain solutions for recording, managing, and syncing financial agreements between regulated financial institutions. The project’s working title is Corda.

BNP Paribas Group‘s assets management department has announced a deal with investment platform Smart Angels to use blockchain technology in providing private companies an opportunity to issue their own securities. The pilot program is to be launched later in 2016 provided regulators approve of it.

Another important and promising initiative was announced by Red Hat Inc. So-called Openshift Blockchain is aimed at fintech startups and independent software providers to enable them to create blockchain solutions hosted on Red Hat’s servers. The corporation, in its turn, would undertake to deploy the applications and provide technical support.

Finally, Russian Central Bank‘s working group on blockchain research announced it may present its findings this June. The basic issue discussed in the group now is exact ways of the technology’s application. The regulator is expected to grant banks a permission to store transaction data on the blockchain.

Events

Four days-long conference Money 20/20 Europe in Copenhagen featured in excess of 3,000 attendees. The event covered development issues of fintech, blockchain technology and its implications on finance, and cryptocurrency regulation. A board of experts met to discuss bitcoin scalability problems and block size issues. Some results of the conference are highlighted in ForkLog’s special feature.

Third Bitcoin Conference Russia took place in Moscow, April 8. It featured several prominent actors of the industry, including Blockchain.info’s Nick Carey. His visit, however, was troubled due to visa issues. Fortunately, everything turned out fine. Carey also spoke to Forbes Russia.

#Bitcoin is alive & well in Russia – today @niccary & @pabloszurek attended a packed #BitcoinConf2016 in Moscow! pic.twitter.com/W8lf7zWo0a

— Blockchain (@blockchain) April 8, 2016

Coordinator of a Russian blockchain accelerator Alex Fork stated at the conference that Vitalik Buterin of Ethereum will visit Russia in a few months.

Two more events have been announced this week. In September, Ethereum Foundation in cooperation with Wanxiang Blockchain Labs of China will hold International Blockchain Week in Shanghai. In May, Prague will host international conference Blockchain & Bitcoin Conference Prague.

Bitcoin Industry in Finland

Finally, this week we published a feature on the current situation in Finland’s crypto-industry. Spokespersons for Finland’s two leading startups, Martin Albert of Bitalo and Henry Brade of Prasos, described the current state of affairs in the country.

Have a nice weekend!

Subscribe to our Newsletter

<Similar Content

- Nick Szabo Casts Doubt on Bitcoin ETF Benefits

- Crypto Market Falls Below $200 Billion to a New 2018 Low

- Ether Falls Below $300 for the First Time Since November 2017 Amidst ERC-20 Projects Sell-Off

- SatoshiPay’s CEO Meinhard Benn Says It Was a Wise Decision to Leave Bitcoin for Stellar

- ShapeShift Acquires Cryptocurrency Trading Start-Up Bitfract

- Ukraine Electoral Commission Trials NEM Blockchain for Voting Process

- Business & Technology University in Tbilisi to Issue Blockchain Verifiable Diplomas

- The Age of Equality: How Blockchain Helps to Reduce Social and Gender Gaps